Adam Cochran: Crypto Wealth Code 2023

The annual Crypto "sweep" list is here again. When you don't have time to research individual assets each time the market drops significantly, you may miss a great buying opportunity. As a long-term investor, I anticipate the possibility of a sharp decline that will cause me to have no choice but to continue to hold down. I expect some assets to go to zero, so I will adjust my purchase list as conditions change.

Every Crypto shopping list starts with the creation of a theme and a buying plan. The themes are the catalysts that will drive the market over the next 3-5 years, and the buying plan is the size of each asset to be purchased and under what conditions. Each year I share my shopping list and discuss the catalysts that I believe will drive the growth of the assets on my list. This purchase list is all based on personal circumstances, risk tolerance and time planning.

Note: The shopping list is for reference only and should not be overly focused on a few assets or on getting in all of them at once. Your shopping list should be of assets that you believe in. Shopping lists are also not set in stone. It needs to be re-evaluated every month, and the shopping list considered in the context of global macro, changing industry events and new developments. In the investment world, staying the same is tantamount to self-destruction, DYOR.

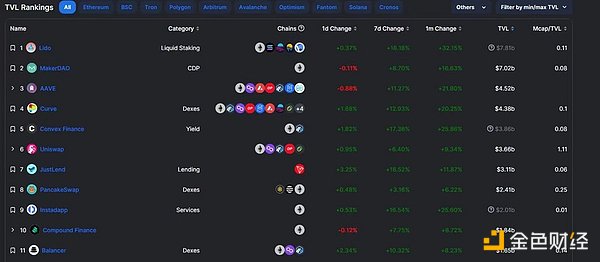

Let's start with a table to give you a sense of Crypto's misery in 2022.

Caution.

1. I own most of these assets, and if I didn't have enough confidence in them, it wouldn't be on my list.

2. I would definitely rebalance some positions if people followed suit directly, but I think these are "long-term winners".

Summary.

1. Real external income remains the most important factor.

However, the assets are so depressed that some "growth" style tokens are facing difficulties.

3. Focus on true revenue "catalysts", novel infrastructure and user experience.

Actual revenues are those used by users external to the project and generate revenue, especially if not supported by ongoing emissions incentives, which eventually lead to user costs. Another important highlight is the user experience.

Not just design, but any tool that makes the process of using blockchain technology easy for users. Just like a web browser or search engine makes the internet easy to use, we need tools that make crypto easy to use. These could be cross-chain bridges, multi-chain applications, automation tools, smart wallets, etc. Anything that makes decentralized, liquid, complex systems easier to use or build.

1. ethereum

(1) Ether doesn't need any reason to be at the top of the list. It has the most users, generates deflation when used, and has a dozen upcoming scaling solutions.

(2) I think investing in ETH long term is like buying internet infrastructure after the internet bubble burst. Everything in the entire industry is suffering and may be overblown in the long run, but that doesn't mean it's not useful.

(3) I personally believe that one day the Ethernet blockchain will become a ubiquitous data layer, and being bullish on Ethernet will be a rare opportunity for participants to achieve wealth freedom.

2. Radiant Capital (RDNT)

(1) Radiant Capital is one of the new projects I'm most excited about in this cycle. It takes the existing cryptocurrency market model and builds it locally across the chain, making it completely community-run.

(2) Radiant Capital is launching first on Arbitrum, which is built on LayerZero, which will allow it to have a native cross-chain marketplace. Users will be able to deposit pledges on one network and borrow seamlessly on another.

(3) Pledge your local tokens on Arbitrum and borrow on Polygon to move to the next farm. use your OP tokens as pledges to borrow USDC for mainnet farming. users will be able to borrow, settle and pay fees across markets.

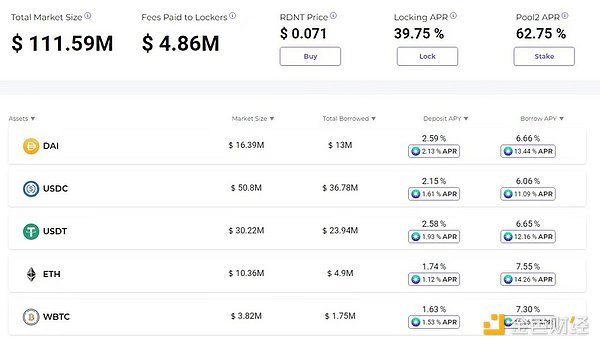

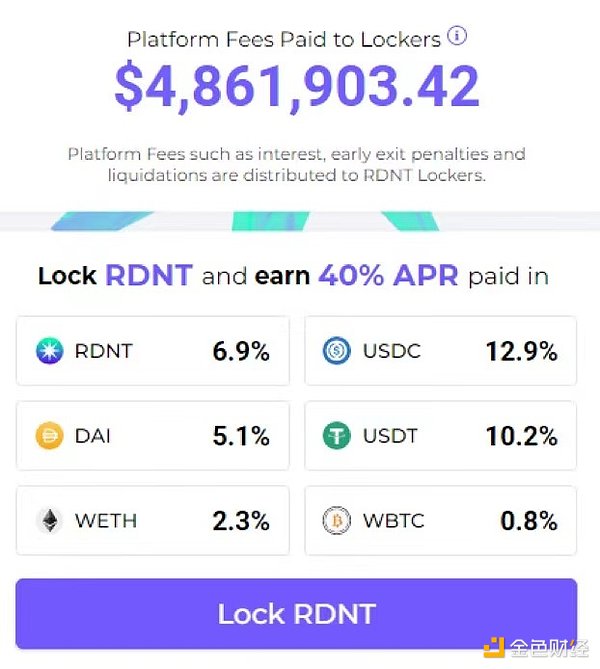

(4) The team started entirely from scratch, with no VC funding or seed round, and unlike Aave or Compound which charge developers a fee, Radiant's agreement rewards all fees to pledgers. This means that pledgers receive a good average annual return (currently 39.75%), but this is not all from diluted tokens, but from real use cases and paid out in actual valuable assets, most of which are in the form of USDC.

(5) In terms of valuation, RDNT is currently valued at only $2 million and FDV (fully diluted valuation) at $70 million, but over time, the bulk of FDV is paid to the pledgees and the dilution is not really equivalent. Considering that Compound's market cap is $365 million (FDV $529 million) and Aave is $1.2 billion (FDV $1.3 billion), there is a lot of room for growth here. But more importantly, even though Aave and Compound are multi-chain, their liquidity is "split".

(6) While Aave hopes to introduce a cross-chain feature called Portal in its V3, it is not yet live and will be limited by the Aave structure. However, Radiant has been considering cross-chain designs from the beginning. I think that whichever team is able to capture a strong market share in the cross-chain lending space could easily be a $5B+ opportunity, and Radiant is off to a great start. This market has been difficult to enter, and if they can pull it off, the rewards will be great.

3. Yearn Finance (YFI)

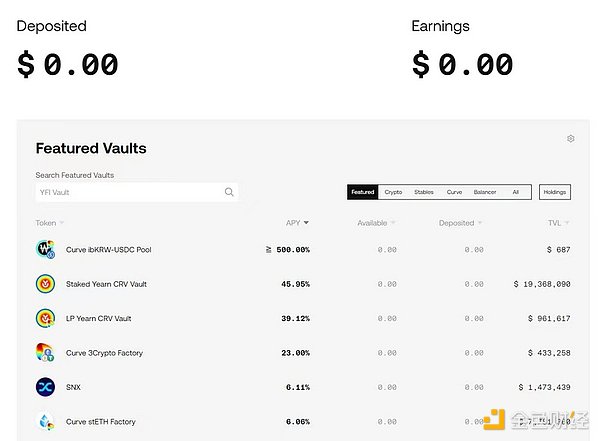

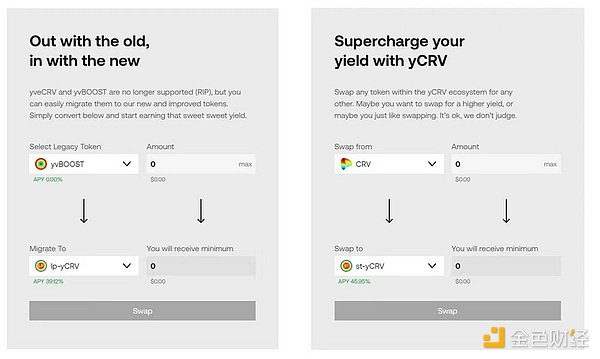

(1) Yearn is the undisputed leader in revenue automation and vaults, and more importantly, has undergone significant changes in their competitive offerings. yearn has recently completely re-engineered their offerings, including a new website: supporting new chains - lowering fees - re-integrating CRV - rebranding YFI tokens.

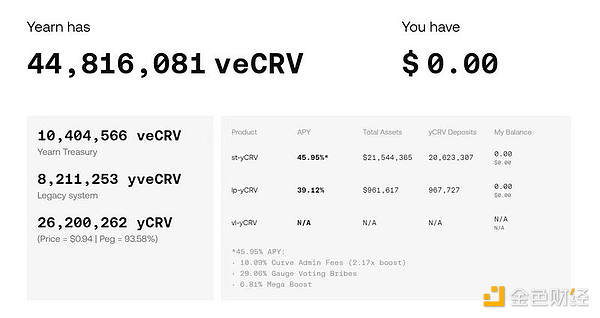

(2) Yearn has a large number of CRVs, in fact, with 44 million locked-in CRVs, making them one of the largest Curve holders in the ecosystem. Having a voting voice in hand will help them get a higher return on their strategic funding pool.

Under the previous model, it was inefficient to acquire and reward CRV lock-in, so they converted the old growth model to a new model of yCRV that now pays up to 45% annualized return at the time of pledge.

(3) More interestingly, however, locked veYFIs will be able to vote to determine which pools receive the votes assigned to them and which pools receive direct YFI awards.

(4) You can think of it as Convex's Votium protocol, but integrated directly into the system, it gains from three places, not a single gain.

1.Yearn funding pool

2.Yearn repurchase of YFI emissions

3. CRV Bonus

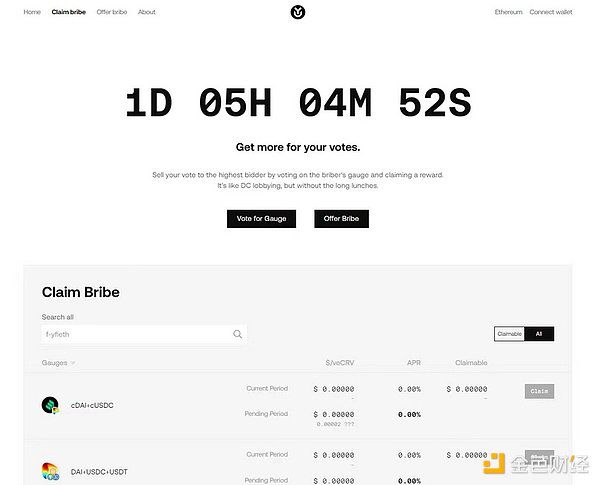

(5) The "bribery" is just beginning, and people seem to be completely unaware of it because participation has been low, which means that very few votes are needed to generate new bribes.

(6) Yearn has also begun creating automation tools that will allow any project to deploy an automated yield pool for their pool and pay bribes to that pool. As the number of templates increases, Yearn will be able to automate large pools of funds for any project.

(7) Yearn funding pools have always been a key component of DeFi's infrastructure, but now they will be scalable, bribeable, and profitable for project integration. Just like Curve War in the last cycle, deploying Yearn Gauge and acquiring YFI will become standard practice.

4. Synthetix (SNX)

(1) Synthetix is a DeFi OG, Synthetix allows the creation of synthetic liquidity backed by asset-based debt. synthetix started as a simple borrowing agreement that allowed pledging SNX and borrowing sUSD.

(2) has now evolved to include Atomic Swap, a perpetual contract engine, and soon there will be a license-free marketplace for building such protocols to unlock your pool of rewards.

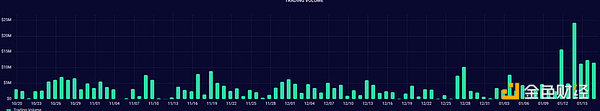

(3) With the integration with Curve, 1inch and other major players, Synthetix V2 "Atomic Swaps" generated huge volumes and you can see how their V2 adjustments led to a spike in volumes even in a bear market.

(4) In the last bull market, V1 trading volume for Atomic Swaps exceeded $100 million per day. Synthetix currently holds this record every month in a bear market, but only between "atomic swaps" and perpetual contracts, which still means that the APY for Synthetix pledgers would be over 70% under current market conditions.

(5) The current version of Synthetix is also only available on the mainnet and Optimism, but V3 is targeted to be available sometime in late Q1/early Q2, and it will support multiple chains, allowing partners like 1 inch to use it immediately on any chain to provide transaction liquidity.

(6) Currently, all markets come from a single pledge and a single source, but V3's new model will allow anyone to build their own protocols on top of Synthetix. They will decide on the pledges, assets, models and returns. They can choose to issue Synthetix's own sUSD and use a pool of funds managed by Synthetix, or they can build their own system against Synthetix's debt pool and decide which pledges to accept. Users can then decide which pools to pledge, allowing any agreement to build a debt guarantee system.

(7) A currency market like Aave, a perpetual contract like Kwenta or GMX, an AMM like Uniswap, Synthetix will provide liquidity services.

(8) The goal of Synthetix is to abstract away the complexity of these deployments so that it can have templated versions that make launching your own DeFi protocol as easy as running a WordPress site or deploying a Shopify store.

(9) The goal of SNX is to be the mobility layer that underpins all of DeFi. First, it will be limited to technical users, but I have high hopes that the community can achieve its goal by being one of the first Dapp-to-Dapp protocols.

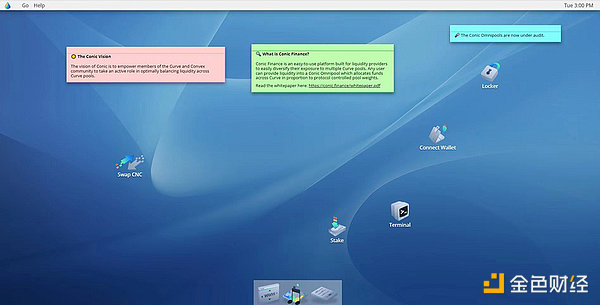

5. Conic Finance (CNC)

(1) Conic could end up being one of the most important ecosystem projects you've never heard of. conic is a key part of the Curve ecosystem, bringing omnipool into balance.

(2) Conic created the "omnipool" which allows users to deposit assets into Curve and spread them across different pools to optimize the APY per dollar.

(3) In order for Curve to launch its crvUSD and take on multiple pledges, its pool needs to be able to absorb liquidation easily. You can't do this if a pool has low liquidity, which poses a huge risk of manipulation.

(4) And that's where Conic comes in. By creating a liquidity fund that moves from one pool to another in search of the highest return. This means that if a certain pledge of crvUSD is liquidated, omnipool can be redirected to that pool to absorb the reward.

(5) This will allow Conic to be the layer that optimizes rewards and allows assets to be entered into the crvUSD system as pledges. Unlike its competitors in Curve War, Conic is also the only responsive system that dynamically adjusts its focus to drive fees.

(6) More importantly, Conic's website was designed to look like a Mac UI desktop, and understanding the complex infrastructure they were building and their insight into why crvUSD needed omnipools, I think it was important for Conic's team to have a Curve team member on board.

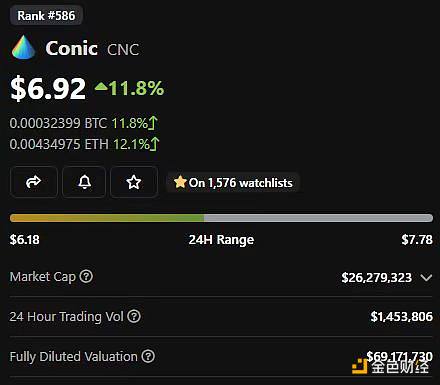

(7) Conic is currently preparing for an offering, so the risk is high. Considering that Convex is currently generating about $3.8 billion in TVL revenues, it could generate $9.7 million per month, even in this depressed market. The valuation of $370 million is about three times its annual revenue.

(8) If Conic is able to capture TVL, there is a 10x growth opportunity even in a bear market where the value of CRV is not growing.

(9) However, Conic can steal market share from any program that has a large CRV reserve or that involves voting bribes for Curve or doing automatic cost balancing.

(10) Currently, even in a bear market, the Votium protocol is generating about $1 million per week in voting bribes, which alone could lead to an immediate valuation of $156 million for Conic. The risks are high, but so are the opportunities, which help strengthen crvUSD's potential.

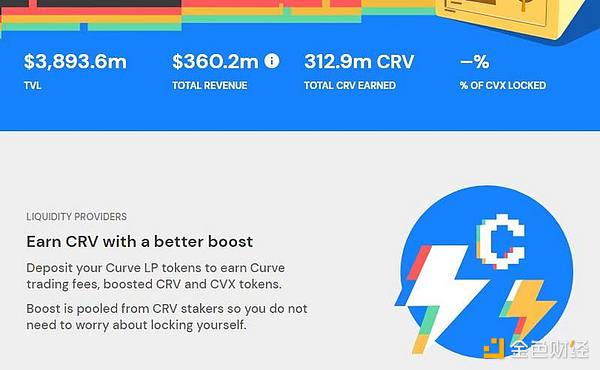

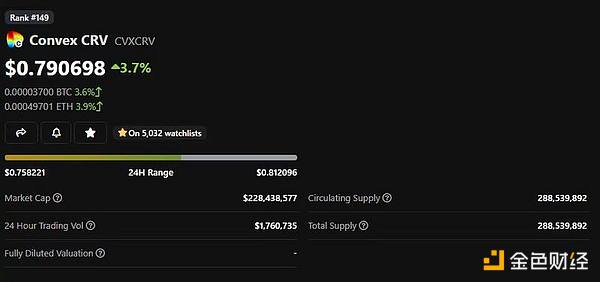

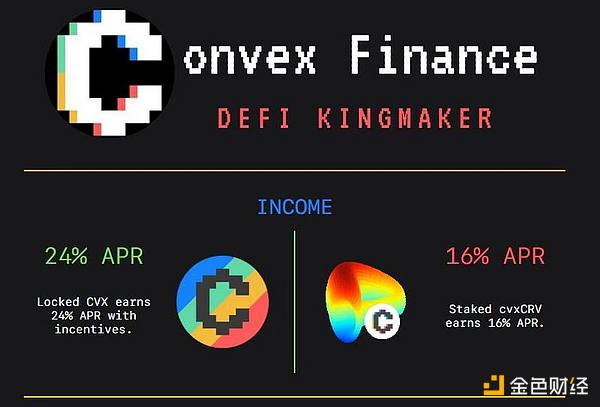

6. Convex Finance (CVX)

(1) Convex is the dominant player in the pool. As you can see from my view of Conic, I think Curve is one of the most important protocols in the space and its value will only continue to grow. That means Convex will be on a united front with it.

(2) While I think Yearn and Conic will continue to threaten Convex's dominance, there is one thing that cannot be ignored. That is, Convex has a locked-in CRV of 288.5 million that no one can shake.

(3) Even if Convex stops issuing new awards or loses market share to new entrants, this voting power will never be taken away and awards will continue to be earned. The cvxCRV is also currently trading at more than 20% below the CRV.

(4) With the growth of crvUSD, people want to cash in their locked-in cvxCRVs as CRVs, which creates this gap.

(5) My personal prediction is that the CVX team will push their crvUSD rewards to cvxUSD to help close that gap. This means that at current prices, by buying cvxCRV (instead of CRV), you will get more than 20% in rewards.

(6) Now, buy CVX and lock vlCVX to get more votes per dollar than the original CRV and get 24% APY from the bribe.

7. Frax Finance (FXS)

(1) Frax is the king of sniping retail investors. frax is becoming increasingly difficult to fit into any one category and is becoming a DeFi monster trying to attack all verticals.

(2) Frax started out as an algorithmic stable, one of only a handful of coins currently able to survive multiple up and down markets. Being a battle-tested algorithmic stable is impressive in itself, but Frax didn't stop there. Instead, Frax decided to actively try out all new areas.

(3) From its trading AMM, to the lending market, Frax is slowly expanding its domain to other DeFi markets.

Most projects that have tried this approach, like Sushiswap, have backfired and spread themselves too thin. But Frax has done a great job of re-binding all of its content to its core market.

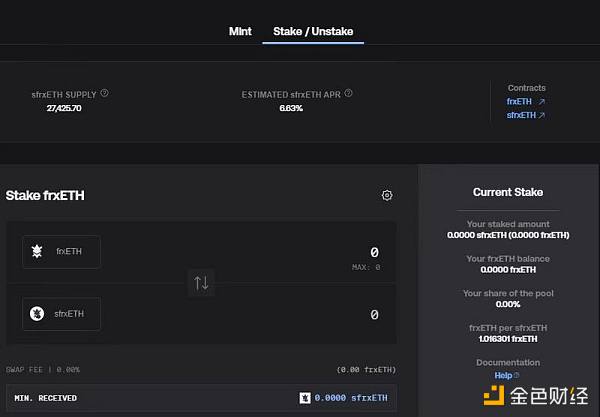

(4) Frax is also a large shareholder of Curve voting rights, which you will notice is a trend this year. They intend to use that Curve voting power to increase the APY yield on their liquidity pledged ETH product, frxETH.

(5) Like competing with cbETH and stETH, they can only offer base ETH proceeds minus fees. By redirecting their rewards (even short-term ones) to frxETH, Frax should be able to capture a large portion of the market share in liquidity pledges over time.

(6) Unlike some of the other programs presented here, Frax's valuation is already quite high and has risen significantly in the last few weeks due to the narrative surrounding the liquidity pledge agreement.

(7) I bought on the last drop and will probably wait for a "cooling off" period before continuing, but I think Frax still has a huge potential market and it can offer the best in class by creating interconnect protocols.

8. Curve Finance (CRV)

(1) DeFi's ups and downs are driven by Curve. CRV voting can change the trend of any project in a single instance, energizing a project or defeating it completely. curve may initially be the most efficient trading protocol of its kind for trading pairs, but it quickly grew into an industry giant, providing incentive liquidity for young projects just starting out.

(2) This model created the "Curve War", where other protocols competed to collect as much CRV as possible to incentivize their own pools. Curve then introduced V2 pools to trade regular pairs with AMMs like Uniswap. Although V2 pools have grown a lot, my gut feeling is that these pools can still be expanded further to provide even higher traffic.

(3) However, I think Curve's current catalyst is two-fold. First, Curve and 1 inch have partnered to integrate Synthetix's Atomic Swap protocol, allowing them to create synthetic assets and swap them inside and outside the Curve pool for better virtual liquidity that does not currently exist. This provides an opportunity for a "new market" route that conventional AMMs cannot compete with.

(4) The Curve V2 pool will benefit as Synthetix scales up assets in this product, allowing users to trade large amounts of liquidity across complex routes.

(5) Secondly, Curve is finally expected to release their long-awaited stablecoin "crvUSD" sometime this month. Instead of a protocol based on regular clearing, the system uses an automated clearing method called LLAMA. This self-liquidating AMM runs through Curve's pool, meaning that liquidation fees will automatically accrue to each LP on Curve, while borrowing fees will flow to veCRV holders (which in turn benefits Convex, Conic, Yearn and Frax).

(6) So why is the Curve stablecoin more interesting than other stablecoins? Part of the reason is that Curve is driving the largest demand for stablecoins in the space, and every stablecoin pair on Curve is paired with Curve's 3 Pool.

(7) Even in a depressed market, 3 Pool has driven nearly $600 million in demand for stablecoins. However, there is no reason why 3 Pool has to own these assets, or that the underlying pair has to be the current 3 Pool.

(8) Curve DAO voters could vote to convert 3 Pool from holding DAI to holding crvUSD, or better yet, could vote that the base pair for measuring eligible stablecoins is crvUSD instead of 3 Pool, which would immediately generate $600 million in demand for crvUSD.

(9) While it appears that Curve will initially only use ETH as pledges, the LLAMA system is a way to ensure diverse pledges. As long as Curve has a V2 asset pool, backed by Conic omnipool, they can liquidate most assets with confidence.

(10) More importantly, the value here is reflexive - as demand for crvUSD increases, more rewards flow to veCRV holders, which makes CRV more valuable, which means more programs want to control CRV voting, which increases demand for crvUSD, and the cycle repeats.

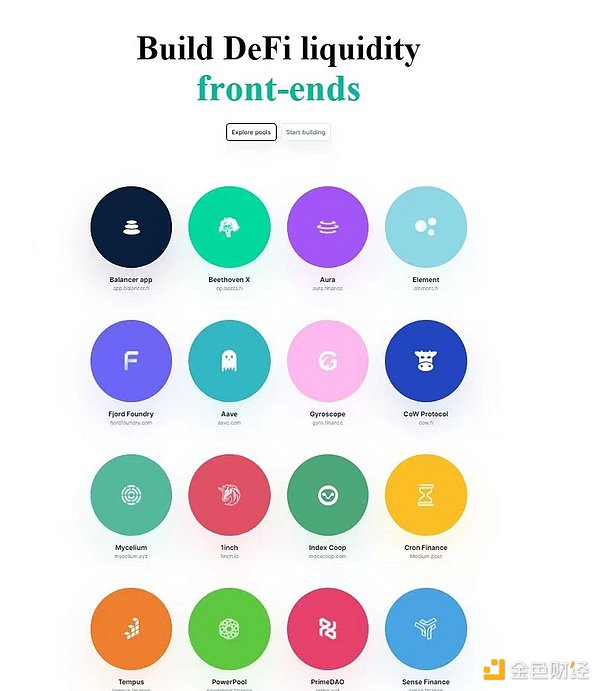

9. Balancer (BAL)

(1) Balancer has been a leader in novel mechanisms and it has two key features that I think will grow in value. balancer is often overlooked. balancer's unique model makes it the foundation of DeFi and I think we are seeing developments where 80/20 pools will be the core value that underpins the next wave of DeFi.

(2) Many teams are realizing that their locked token models (like xSushi or veCRV) are problematic. Because while lock-in tokens create scarcity and upward liquidity, they also create illiquidity for big new buyers and weak bottoms in bear markets.

(3) At the same time, you cannot ask users to pledge regular AMM pairs because erratic losses will destroy returns or positions will become so concentrated that your asset will never really go up or down and will become a useless asset.

(4) What to do then? This requires balancing the 80/20 pool, and that's the way Balancer uses it. By allowing users to hold their own tokens and 20% of ETH, they ensure strong liquidity, but with lower impermanent losses for the user.

(5) Of the teams I've talked to recently, about 12 are redesigning the token economy, and eight of them are talking about using 80/20 pools - something that only Balancer really offers at this point.

(6) As I mentioned in last year's Wealth Code 2022 article, I see Balancer as a B2B protocol that can provide a unique liquidity product to other partners, and they are really better at it.

Balancer already has nearly 20 new partners and is growing its market share. This is the first time they are close to the top 10 in TVL at DeFi. Even during the crash, they controlled their TVL better than most programs as Balancer added new partners, not just new users.

(7) But as I said last year, I think Balancer is a program that brings you unexpected wealth when you use it unknowingly because it is a core infrastructure.

(8) Balancer is a long term play that will either become a core pillar of DeFi or fail. But for now, they're doing a great job of slowly phasing out new partners and and unique integrations, so I'm still a buyer of Balancer this year.

10. Cosmos (ATOM)

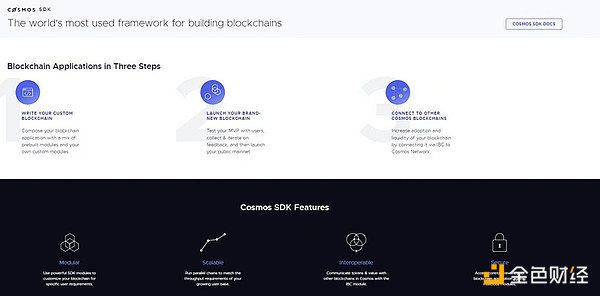

(1 ) Cosmos is an interconnected blockchain network that can be easily designed for custom interoperability. I'm skeptical when it comes to other L1s. It takes a high standard of innovation and bringing a unique product to get past me. Cosmos achieves this with a simple modular SDK that allows anyone to build small custom blockchains using interconnection standards around communication and tools.

(2) This means that you can create a niche blockchain that is designed as a dedicated AMM like Osmosis, or a cross-chain bridge like Gravity Well, or hosted like Akash, all of which have standard ways to communicate and interact locally.

(3 ) Personally, I think the race for the monolithic blockchain as the core settlement layer is over. Ether has won the race.

The next matches were.

1) Who wins on L2.

2 ) Who wins in the niche application chain.

(4) Many competitors in the application chain space (e.g. Avax, Polygon, and BSC) are building application chains in a standard way; in fact, they are more appropriately called "microchains" than application chains, and Polkadot's Parachains encountered significant challenges early on, which caused them This hurt them.

(5) Cosmos, on the other hand, focuses on building simple tools and standard connections, but otherwise tries to keep components modular rather than limiting the creativity of the builder.

(6) Outside of the Ether ecosystem, we don't see a lot of innovation, and we often see only incremental improvements. But Cosmos is one of the few projects where we see exciting experimentation and implementation of innovation.

(7) So I think Cosmos is likely to be one of the non-Ethereum winners that ultimately comes out on top, and it's an ecosystem full of opportunity.

11. Keep3r (KP3R)

(1) Keep3r, with the aura of an AC project, is an important automation tool that has underpinned much of DeFi. That's part of the reason why it's a little lower on my list this year, but I still believe it's in the hands of talented builders and will continue to be a core infrastructure for DAO. The main reason remains that they are the only protocols running in large-scale automation.

(2) My prediction is that in this cycle we will see a lot of the old DeFi teams disappear and their applications will come to a standstill because there is no one left to run the regular functions.

(3) Keep3r will play a key role as we continue to build more advanced cross-chain products and improve decentralization. Others like Chainlink and OZ Defender have their own automation tools. But so far, no tool has been adopted and has as wide a decentralized participant base as the Keeper network, so I still think Keep3r will be a long-term winner.

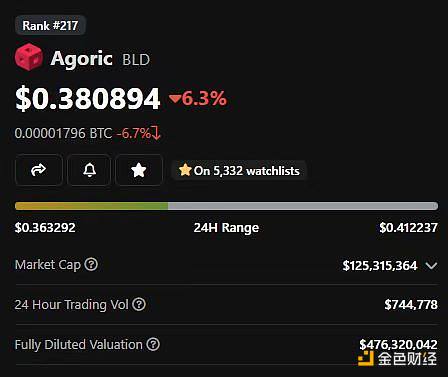

12. Agoric (BLD)

(1) Agoric is a Cosmos-based chain that implements a unique design model for security and accessibility. Unlike most protocols in the space, which rely on smart contracts to hold your assets, Agoric is built from the ground up to allow users to interact with DeFi while keeping their assets in their own wallets.

(2) Agoric currently has a market cap of $125 million (FDV is $476 million). agoric has a lot of room to run and could be a unique and competitive L1 product.

13. ZCash (ZEC)

(1) ZCash has received a lot of criticism in the past because people confused transparent addresses with masked addresses, arguing that they were optional privacy. zCash has also taken a beating because.

A) was acquired by Digital Currency Group.

B) have a very high reward for continuous mining.

C) is a separate coin, not a platform. And, everything is about to change.

(2) ZCash is moving to PoS, just like Ether, and while the timeline is still in flux, my guess is that it will happen sometime late this year/early next year and dramatically change the supply and demand for ZCash.

(3) The ZCash community is also deeply exploring allowing other tokens to be issued on ZCash and using ZEC as gas. once users are able to migrate tokens to Zcash, it will quickly unlock new DeFi opportunities.

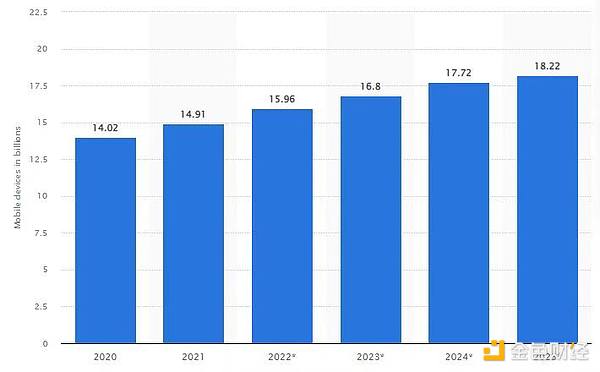

(4) While the ethereum community is racing to perfect the zero-knowledge proof of L2, this is something the Zcash community has been doing since day one. They currently have transactions that run at speeds that can be run on cell phones in seconds. By comparison, something like Polygon's zkEVM currently requires a proof program with 1 TB of RAM and 128 CPU cores. It's a whole different ball game.

(5) It is estimated that by 2025, the number of mobile devices (phones, ipads, smart watches, etc.) will exceed 2.5:1. Someone is going to be the winner in mobile encryption. I think ZEC's fast payments have an opportunity to be done offline by proving and supporting DeFi.

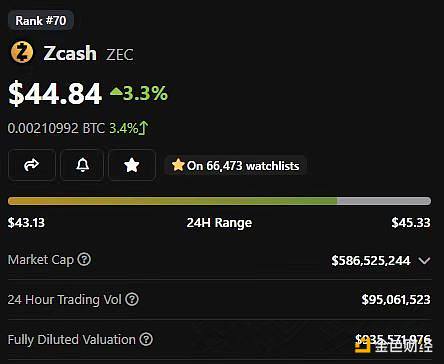

(6) Imagine being able to transfer money and make transactions from a simple, low-end device in seconds, all privately, no matter where you are in the world, even with limited connectivity. This is a dream that many cryptocurrencies have been pursuing, and ZCash is well on its way to making it a reality. Market capitalization is only $586 million (FDV is $935 million).

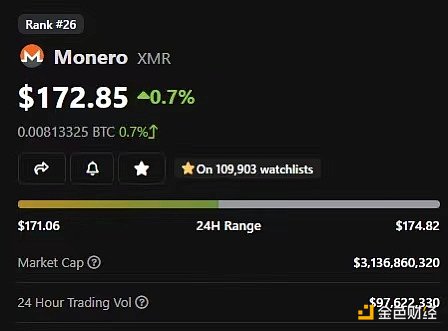

(7) Compared to the largest privacy coin, Monero, which has a market cap of $3.1 billion and a market share potential of 6x even if the market does not rise, Monero is also not a platform. Therefore, considering the L1 value, ZCash has a higher potential.

14. Alchemix Finance (ALCX)

(1) Alchemix broke the mold by designing the first self-repaying loan. But then the market plunged, yields plummeted, the loans would never be repaid, and they started to struggle. However, Alchemix did a good job of redesigning V2 to gain good traction even in a bear market.

(2) Their V2 now allows for self-repaying, non-liquidating loans with pledges of up to 50%. That means if I have $100K in ETH, I can borrow $50K in ETH without worrying about liquidation.

(3) In a large market environment, your entire position can easily be closed out. But with Alchemix, if the market goes down, you won't be closed out, it just takes longer to recover your principal. This means that Alchemix allows me to take on up to 50% of loan value with minimal risk. And, as the value of the pledged collateral rises, the annual return on the capital pooling strategy rises again and my loans are repaid faster.

(4) Alchemix has a market cap of only $30M (FDV is $40M) and its TVL is more than 3x its market cap even in a bear market. My hunch is that while the average user uses a self-pay loan in a bull market, the smart buyer will use it to buy discounted assets in a bear market.

(5) I think this team has strong long term potential as the APY funding pool rate continues to pick up, Alchemix expands into other chains, and integrates new strategies on an ongoing basis. Especially if they expand the number of assets they cover.

The prediction is that in the future they will deploy on each chain to provide a simple way to leverage lending against local assets pledged on that chain. If they can do that, I can see the potential for 20x+ over the long term.

(6) There is no denying that Alchemix is uniquely positioned to offer a new value proposition and can rapidly scale up to gain access to locked-in capital across multiple chains.

15. Canto (CANTO)

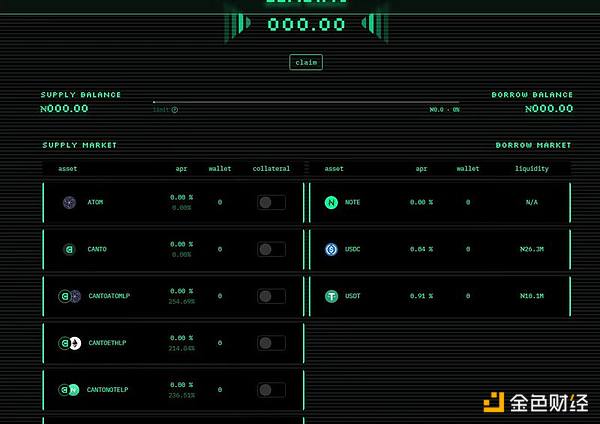

(1) Canto is a Cosmos-based EVM chain. canto's goal is to replace fee-based infrastructure with a public product designed to help reward decentralization. For example, it has its own built-in local lending protocol and AMM.

(2) These built-in systems do not charge any fees except for the basic incentives of the LP. It also has its own local stable coin (NOTE) built into the loan market and managed through rate controls.

(3) But I think the really unique design principle that makes Canto successful is its model around fee rewards. In a future version, when you deploy a smart contract, that contract will have a unique NFT attached to it.

(4) The NFT will receive a portion of all CANTOs associated with your contract for gas rewards. This means that the protocol will be profitable based on its usage rather than a fixed fee model. This encourages developers to design protocols and systems that benefit the common good, not just those that can extract the most fees.

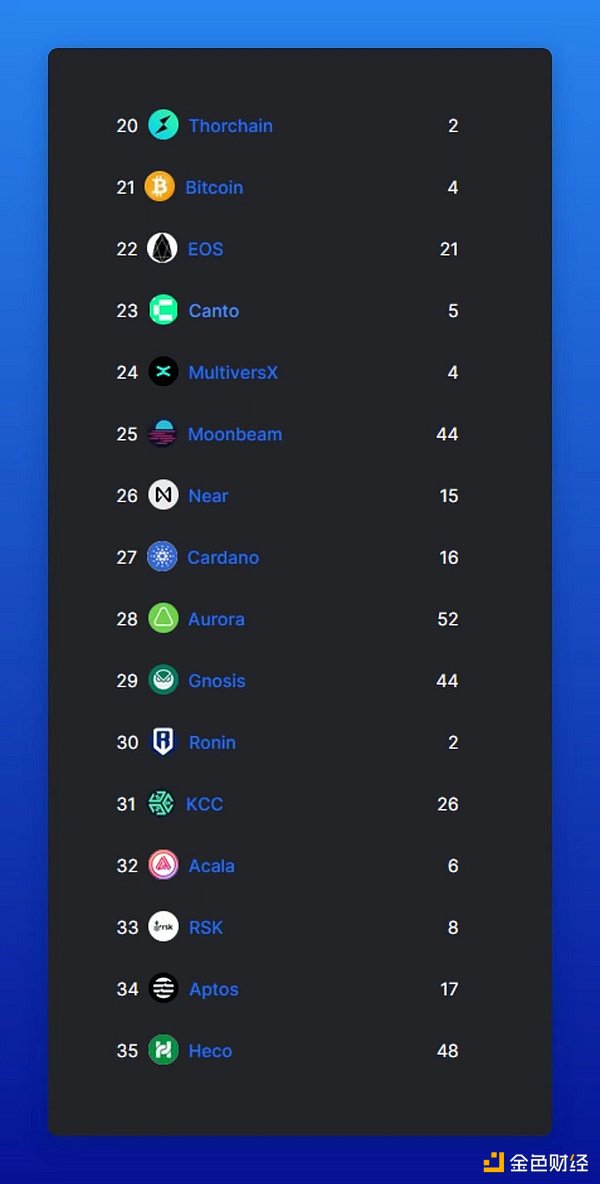

(5) CANTO has more TVLs than many other larger chains, well ahead of Near, Cardano, Gnosis and Aptos, all of which have multi-billion dollar market caps. canto has a market cap of $47 million (FDV is $118 million).

(6) Building a new L1 is difficult. Maintaining user interest in a variety of new protocols is difficult (especially when they compete with free built-in protocols) Canto will need to rely heavily on its gas rewards program to keep the momentum going. If Canto can develop some novel use cases that are hard to cash in on elsewhere, this could be a real win. Consider a royalty-free NFT program, or a royalty-free AMM.

(7) My prediction is that in the next few months we will see some innovative trials on Canto that will have a lot of growth potential if they can start to capture some markets. Most importantly, the current pledge ROI is 21%, which acts as a big cushion against downside volatility.

(8) And lending on a stablecoin pair of NOTE/USDT or NOTE/USDC, the APY of the stablecoin is 11% -12%. This is one of the best sized stablecoin yields I have found on a reliable network.

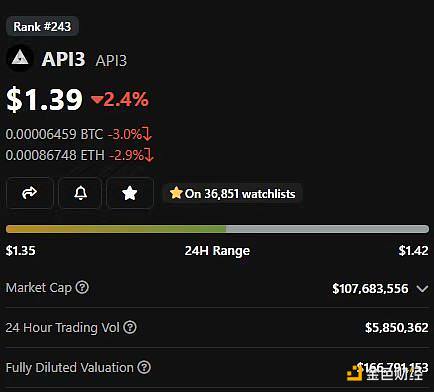

16. API3 DAO (API3)

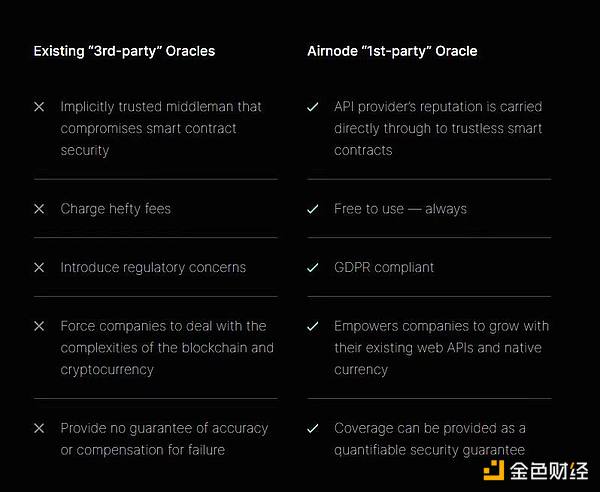

(1) Oracle in encryption has several core issues.

1) Free feeds are standard, but cannot last forever.

2) Feed payment is unstable.

3) Cannot easily use multiple API sources.

(2) API3 aims to address these challenges in a novel way, with an "Airnode" design that allows you to connect any API to Web3 in a trust-free way, allowing you to run it in a cost-free third-party manner. I would like to see API3 built in a more open way.

(3) This does not mean that I think API3 will be the default Oracle provider for all DeFi. But in terms of risk vs. reward, they have a clear opportunity for growth.

17. AngleProtocol (ANGLE)

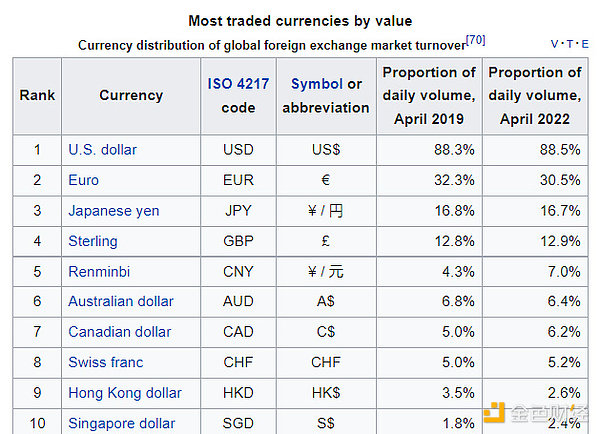

(1 ) So far, cryptocurrencies have been centered on the United States, and the stability of the U.S. dollar is very important.

(2 ) As uncertainty in the global economy begins to recede and we see emerging markets begin to become viable investments again, there will be increasing interest in holding and trading other currencies.

(3 ) The cryptocurrency foreign exchange market is actually the largest in the world with trillions of dollars of capital traded daily, none of which is on the chain so far because there is no viable non-dollar stabilized currency.

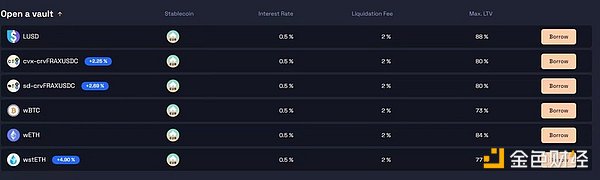

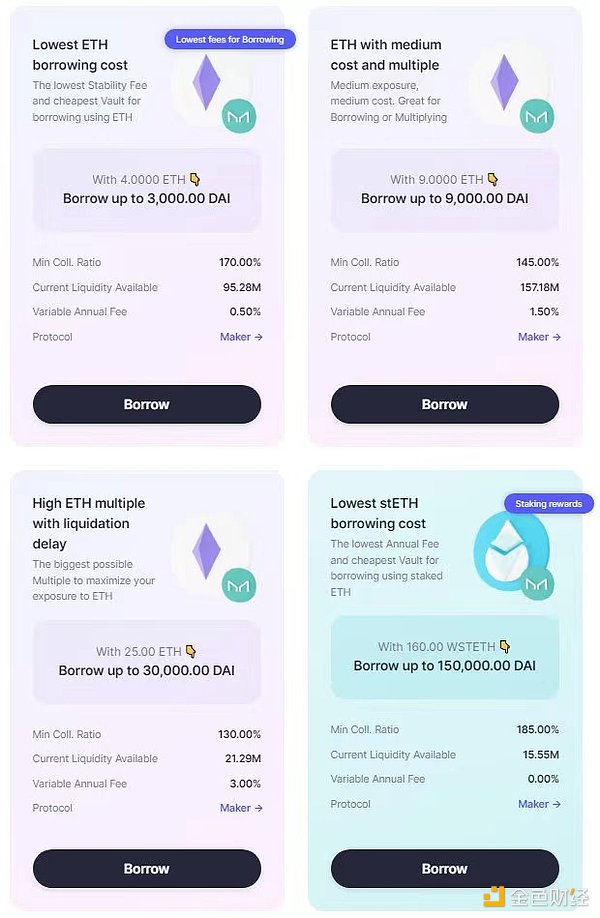

(4) Angle wants to change that by using their agEUR as a MakerDAO for Euros, allowing you to open a pool of funds on a variety of pledges at low interest rates.

(5) Currently, users can borrow agEUR at a fixed rate of 0.5%, secured by wstETH, wETH, wBTC and other stablecoins. Considering the low interest rate, even if you immediately convert agEUR to USDC, this is the lowest cost stable ETH borrowing that exists today.

(6) To borrow DAI on MakerDAO, you either pay an APR of up to 3% or get a lower loan-to-value ratio.

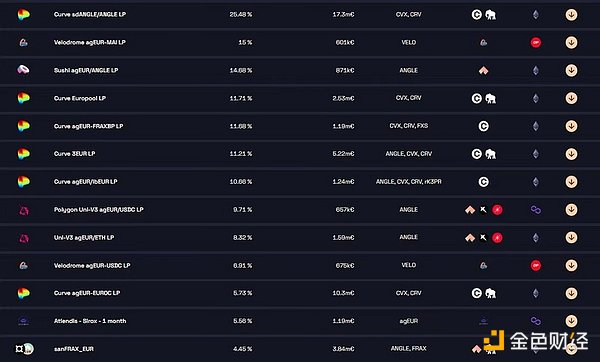

However, if borrowing in euros, you can still get rich rewards through its incentive pool, which covers multiple chains and pays 4% - 25% for stablecoin EUR/EUR trading pairs.

(7) This means that unless you think the USD/EUR exchange rate will fall by more than 25% again this year, you may choose to invest in EUR pairs over USD pairs at popular farms like Convex Finance or Velodrome Finance.

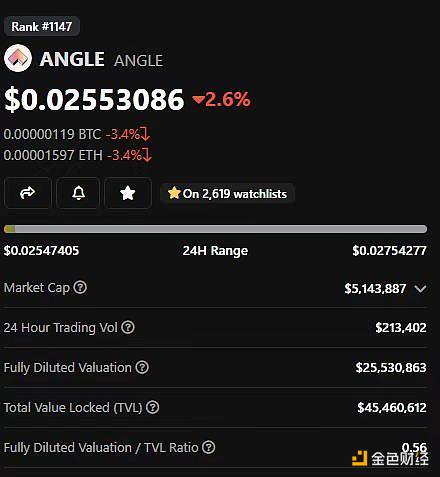

(8) Meanwhile, ANGLE's market capitalization is only $5 million and FDV is $25 million, with plenty of potential upside considering that the euro is the second most traded currency in the world.

(8) One of the ironies of cryptocurrencies is that it is difficult to make stablecoins on their own because much of the liquidity in stablecoins comes from stablecoin trading pairs on Curve. On-chain EUR liquidity is slowly growing with the launch of Circle's EUROC and Synthetix's sEUR.

(9) My prediction is that Angle is still a few years away from taking hold, and as liquidity grows they will need some large OTC trading platforms to help them settle actual euros. But as the Eurozone recovers, many Europeans will want to hold their Euros on the chain, and as on-chain transactions become faster and cheaper, more and more FX transactions will move to the chain, and Euros will be a large part of that.

(10) If Angle wants to succeed, they need to maintain a diverse but secure pledge base, actively seek out incentive partners, and start using agEUR as a pledge on other platforms. But given the outstanding global demand for the euro and its lower market cap, the risk-reward remains a good opportunity for me.

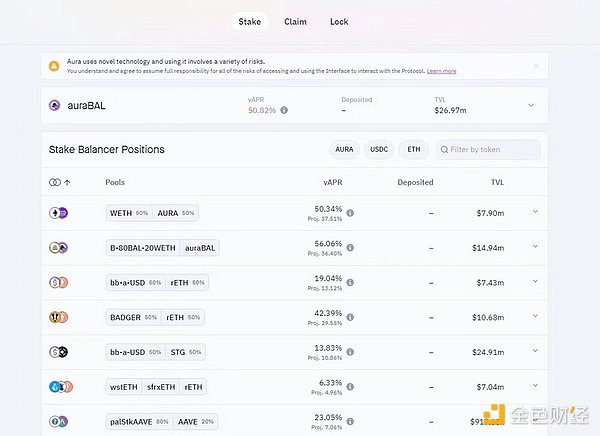

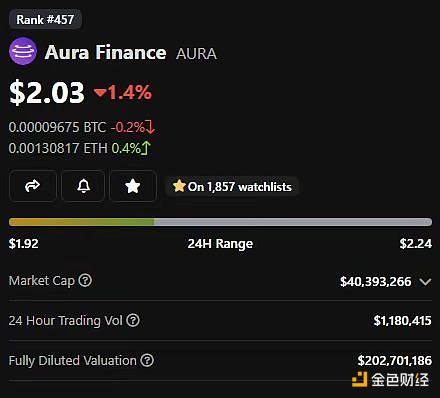

18. Aura Finance (AURA)

(1) Aura is to Balance what Convex is to Curve, a locked-in liquidity pledge market that helps increase the rewards of the Balancer pool.

(2) If you believe in Balancer's theory, then it's easy to get started with Aura. I like these locked token games because they really reward people who can patiently buy and hold for 3-5 years.The market is all about transferring money from the impatient to the patient.

(3) Aura does this while giving you 50% of APY on pledged tokens, and if Balancer does grow in ongoing demand, a Balancer-voting bribery protocol (similar to the Votium protocol) may eventually emerge.

(4) Also, this is a great farming opportunity to get higher rewards in the pool even if you don't have a large pledged BAL position yourself.

(5) Aura has a market cap of $40 million ($202 million FDV), which is a very attractive rate considering they hold $27 million in BALs locked in permanently and will only release Aura when they acquire new BALs.

(6) As we have seen with Convex, they can be extended to other chains, even like Convex using other Frax products, thus extending the range of applications.

(7) There are potential catalysts in the current market conditions. However, I think these tokens are more likely to go down than up, but if they go up, the returns are huge.

19. Gearbox Protocol (GEAR)

(1) Gearbox is one of the most interesting new use cases in DeFi, creating a leveraged lending money marketplace for DeFi applications, ultimately allowing users to participate in on-chain leveraged farming.

This is a powerful mechanism that has generated some pretty strong gains for those offering assets. Stable coins that gained more than 5% in the unilateral non-invariant loss pool on the main network are now largely extinct, except for Gear.

(2) Their pre-built strategy allows you to enter simple one-click farming positions and get more APY. however, it is currently limited to a group of white-listed users as it scales up.

(3) Gearbox is growing slowly, but with an emphasis on its quality. If the team and community want to scale, they need to continue to leverage new assets and new strategies.

(4 ) But in general, the opportunity to be the only true source of leverage without over-pledging is huge. This is a market worth tens of billions of dollars if you can take advantage of the opportunity and cash in safely.

20. CapDot Finance

(1) Cap is a community built, owned and operated DEX that allows perpetual futures and margin trading. Their V3.1 was a big hit on Arbitrum and their V4 promises to add hundreds of new assets to their perpetual product engine.

(2) Rewards are given to users who pool their assets to provide liquidity to the exchange, and then the remainder is used to repurchase CAP tokens. This makes the program quite profitable for small retail investors.

(3) CapDot Finance still has a long way to go, but it's a dynamic young program that continues to deliver at a phenomenal pace and is on its way to becoming a giant like DyDdoxx.

21. LooksRare (LOOKS)

(1) I think the NFT market will continue to expand. And I don't think OpenSea is up to the task of domination, Blur will be overpriced and will focus more on professional traders, and I like rewards.

(2) Among the existing attractive NFT markets, LooksRare is the only platform with rewards, not too expensive, and not like OpenSea. 22%'s APY is paid in LOOKS and wETH, and commissions are fairly stable.

(3) LooksRare will have to fight back against Blur to regain market share, but I think they can do so by focusing on Polygon and L2 and targeting consumers who were scared off by the Blur interface.

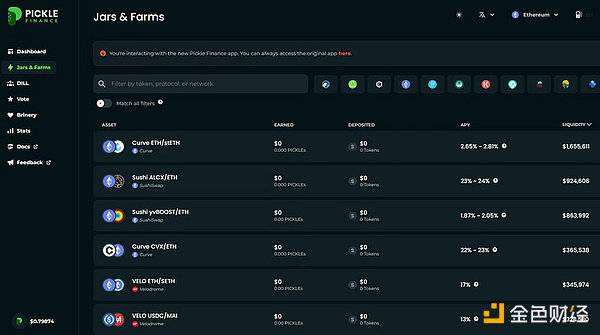

22. Pickle Finance (PICKLE)

(1) Pickle is a bit like the Yearn pool of funds, but for automatic compounding of rewards. It was a big hit at launch, but died out in the previous bear cycle. However, the team is still running, and their V2 supports almost all chains and thousands of farms.

(2) Despite this, you can still earn a generous APY using Pickle Jars (money pools) and will pledge Pickle, vote on which pool gets rewarded, and receive a share of the fee, which is currently rewarded at 19%, which is quite substantial for a low usage market cap. the market cap of Pickle is $643,000 and FDV is $2.4 million. The market cap is smaller.

(3) Pickle was on my buy list last year before they launched V2, and it's on my list now, but I don't own it because I can't actually buy enough of it to make it worthwhile. I've been waiting for it to develop so I can buy it in reasonable quantities.

(4) I hope Pickle can solve some of the liquidity challenges, such as incentivizing 80/20 pools for Pickel/Weth pools so that there is better liquidity on the chain, and that they continue to work on creating a useful, efficient and yielding product.

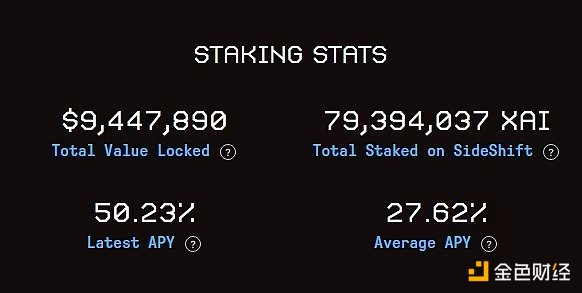

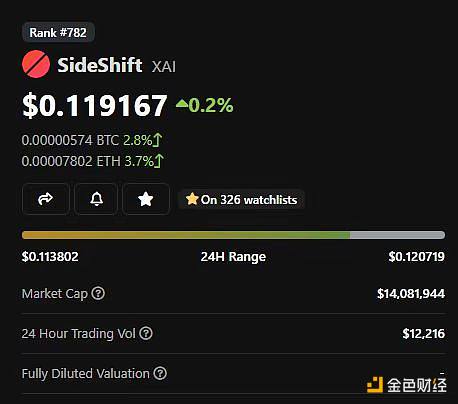

23. Sideshift (XAI)

(1) Sideshift is a no-registration, no-KYC, non-custodial exchange that performs instant delivery of cross-chain and cross-asset transactions. You do not need to register or share personal information to use multiple chains for transactions.

(2) Competitors like ChangeNow offer fiat currency transactions, so they require KYC under certain thresholds. sideshift only uses cryptocurrencies and stablecoins, and therefore is not considered a money services business for most jurisdictions.

(3) Most competitors also don't allow you to trade with privacy coins, while Sideshift supports both Monroe and ZCash, including ZCash shield addresses. It has a wide range of assets in each chain.

(4) It supports Ether, Optimm, Polygon, Fantom, Tron, Cosmos, Avalanche, and Arbitrrum for EVM chains. As well as Bitcoin, BSC, Cronos, Dash, Dogecoi, Litecoin, Tezos, Ripple, Stellar, Solana, Polkadot, and Kava native chains.

(5) Their native token XAI, like their transactions, is offered to individuals who are not on a US IP address. When pledging XAI, access to 50% of Sideshift's daily transaction fees, currently 50% of APY. Sideshift is valued at $14 million.

(6) Services like Sideshift used to be more popular because they were key to cross-chain transactions before Ether's EVM space got stronger. Projects like Shapeshift used to be among the biggest and most profitable.

(7) When EVM dominated and everything shifted to ETH Delta and Uniswap, they both suffered a heavy policy blow and reduced interest in cross-chain transactions.

(8) My prediction is that as transaction chains become more fragmented, there will be more and more of these types of transaction services. After all, they essentially just act as bridges, and there are actually more options available.

And finally Clipper, Polymarkets, Llama Airforce, and Polynomial are also on my watch list.

Hopefully the market will eventually improve this year and we'll all just go up and down.While 2022 will be a challenging year for cryptocurrencies, it will also be a very interesting one.

Note: This article is not investment advice, nor is it a prediction of where things are headed, and certainly not a blip.