Bitcoin 2023 Trend Forecast - Dexnav Blockchain Navigator

Bitcoin 2023 Trend Forecast - Dexnav Blockchain Navigator

As 2022 comes to a close, we look back on a year of turmoil and ups and downs in the crypto market, with bitcoin undergoing further profound changes in the process. This round of bear market is very different from previous bear markets and has shown many new features. The first part of this article reviews some of the notable changes in the crypto market in 2022; the second part focuses on the qualitative changes in Bitcoin during the current bull and bear cycle; and the third part focuses on the main factors behind the changes affecting Bitcoin, thus making predictions for the trend development in 2023.

Review: 2022 was a brutal year

In 2022, Luna thundered, Three Arrows Capital fell, the once crypto giant FTX came crashing down, the once crypto leader SBF may become one of the biggest crooks ever, and now DCG's crisis has not yet been picked up and removed, and the panic about Cryptocurrency is still fermenting. There is no doubt that 2022 is a very brutal year for the fall of many crypto giants.

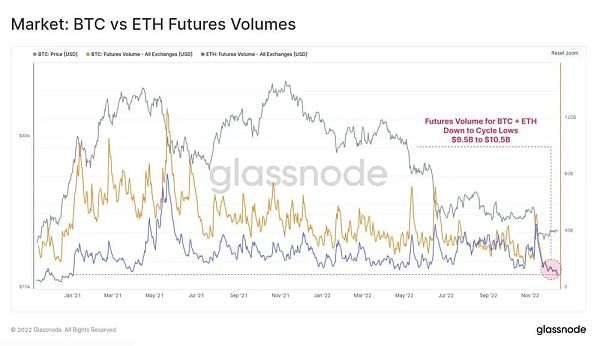

According to Glassnode: crypto futures trading volumes are low, similar to the BTC and ETH markets currently trading between $9.5 billion and $10.5 billion per day, showing the huge impact of tightening liquidity, widespread deleveraging, and damage to many lending and trading sectors in the space. 2020-21 Bitcoin investors shifted money to the chain for over 455 billion in annual profits, and since then the market has clawed back over $231 billion in realized losses.

While 2022 has been a brutal year, new hope is being birthed in the bear market, chief among them being that the Ether merger has finally come to fruition at long last. Since the merger, the number of active Ether validators has increased by 13.3% and there are now over 484,000 validators running, Ether has officially entered the deflationary phase, Ether 2.0 is making great strides on the way, and tracks like Layer 2 are preparing for the next round of bull market explosions.

Change: Bitcoin's Qualitative Change in the Current Bull/Bear Cycle

Since its birth in 2008, Bitcoin has gone from existing only in the crypto-punk community to becoming familiar to people all over the world, and in the current bull and bear cycle has become the fiat currency of some small countries. As Bitcoin continues to grow and develop, the factors that affect its price and the weights that influence it are also changing dramatically and showing new characteristics in the new cycle, which are mainly manifested in the following areas.

Exploring: Influencing Factors Affecting Bitcoin Trends

This article argues that the factors affecting bitcoin can be divided into two main forces, internal and external, or influenced by two core economic cycles. The first is Bitcoin's own four-year halving cycle, and the second is the macroeconomic cycle.

Talking about the economic cycle impact regarding bitcoin itself requires an understanding of the economic design principles of bitcoin. Bitcoin has designed a very scientific set of economic incentives. Bitcoin miners receive network rewards for maintaining and running the Bitcoin network, and this incentive is halved every four years, meaning that miners' mining rewards are halved in four years. However, in addition to mining rewards, the Bitcoin network also provides miners with fee income for packaged transactions. The Bitcoin network starts out relying heavily on inflationary incentives, and as more people slowly use the Bitcoin network, the miners' fee income becomes a major part of it. So to speak, every four years is a "survival test" for Bitcoin. Every four years the incentive inherent in the Bitcoin network decreases, so whether or not miners are motivated to keep the network running after a four-year cycle depends on whether or not the value of the network can be increased. If the bitcoin network does not grow in value, miners will not stay in the bitcoin network without a profit motive. Bitcoin has been designed to successfully regulate the four-year bull/bear economic cycle through the hand of the market with a four-year halving cycle. This four-year halving cycle is in fact the traditional economic cycle of Kitchin, so I will not go further into this article.

Let's talk about how the macro hand affects bitcoin. At the beginning of bitcoin's development, miners had more mining rewards, and it can be said that miners throwing smash had a very big impact on bitcoin prices, and the bitcoin market showed many retail characteristics, but currently miners' mining rewards are decreasing, and their influence on prices is diminishing. In contrast, this influence is gradually moving in and out of the bitcoin network to determine the value. There is no doubt that since 2020, along with the de-Chineseization and the massive participation of institutions from the United States and other countries, the macro financial markets are becoming more and more influential, and the main influencing factors in the macro markets are the Federal Reserve monetary policy and the performance of U.S. stocks, etc. This is also the reason why many market analyses, at the moment, tie bitcoin movements closely to U.S. stocks and Fed policies to see.

The point of this article is that the current market analysis of bitcoin either places too much emphasis on the macroeconomic impact on bitcoin or argues that there is little correlation between bitcoin and macro, instead focusing primarily on the four-year bull/bear cycle. This focus on only one end of the spectrum is undesirable, and these analyses seriously ignore the combined effect of both internal and external influences on bitcoin. The following section of this article will analyze bitcoin 2023 trends in both on-chain data and macro market dimensions.

Data on the Chain: Bitcoin Cycle Bottom May Play Out as Scripted

Statistically, Bitcoin has historically bottomed 477 days before the halving, then climbed all the way up before starting to rise again. The post-half rally lasts an average of 480 days, from the halfway point to the top of the next bull cycle. If history repeats itself, Bitcoin's price will bottom on December 30, 2022, and Bitcoin's on-chain data is currently confirming this cycle script.

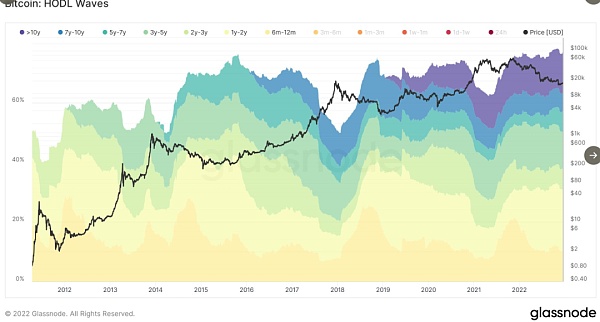

Will Clemente (@WClementeIII) tweeted: 77% of bitcoin has not moved in at least 6 months; 66% of bitcoin supply has not moved in at least 1 year; 26% of bitcoin has not moved in at least 5 years; 13% of supply has not moved in at least 10 years. Absolute scarcity + some tokens lost forever + committed holders.

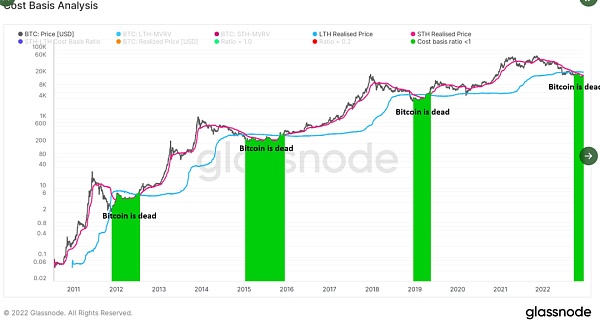

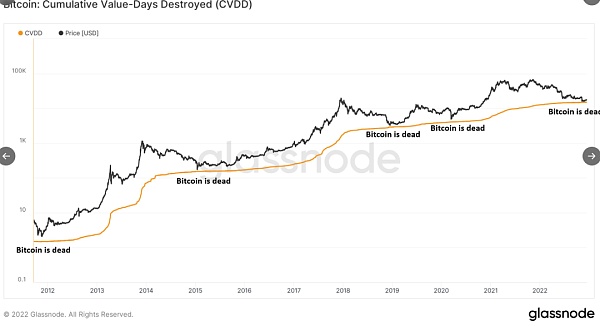

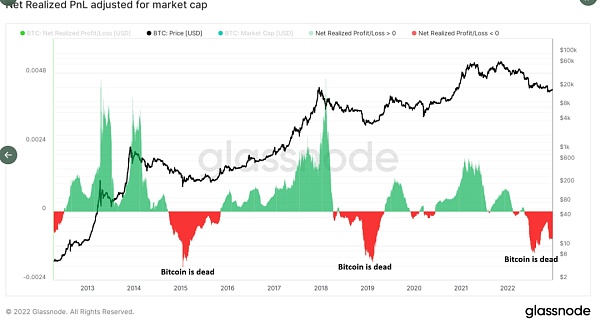

Will Clemente later tweeted that Bitcoin is dead. (Note: From the graphic he posted, all four sets of on-chain data suggest that the bottom has arrived)

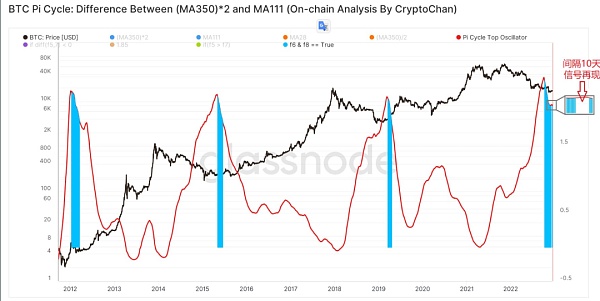

CryptoChan在推特发文表示:根据Pi Cycle指标开发的 #BTC 大周期底部趋势逆转指标(当“(MA350 * 2 – MA111) / MA111”的7日净变化为负,用蓝色信号标出)观察,当前蓝色信号在中断10天后再次续上。(注:图中黑色线为比特币价格线,从图中数据观察看,蓝色信号出现后,比特币价格在随后一段时间都出现了上涨,该指标应为比特币见底指标。)

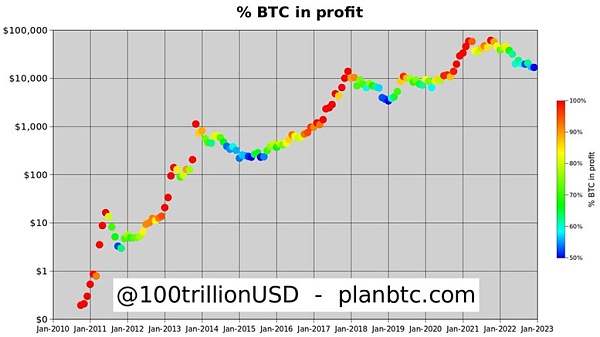

PlanB (@100trillionUSD) tweeted that only 50% out of 19 million BTC is in profit anymore. Historically, this correlates well with bear market bottoms. Time will give the answer.

Macro: Inflation tops out, but influence on bitcoin will wane

As you can see from the data above, many of the on-chain numbers already clearly suggest that "the bottom is in" for bitcoin. However, as we have analyzed, a lot has changed in the middle of this bull/bear round, most importantly the institutional nature, US regulation and the increased influence of financial policy. The institutionalization of the crypto market has caused this round of bear market deleveraging to be expected to take longer, and the bottom expected from the on-chain data may be pushed back, at least for now, looking at the DCG crisis and the panic caused by Coinan is still very big, and the bottom of the crypto market needs further confirmation. Meanwhile, the U.S. crypto market regulatory policies are expected to land one after another next year, and there is still a lot of uncertainty in the market before the boots fall, such as whether USDT will storm.

In the future, although bitcoin will still be influenced by macro for a while, this influence will continue to weaken, because bitcoin's own cycle has indeed bottomed out, and the recent bitcoin market performance has had the feeling that it can't go down. There is a pessimistic analysis that bitcoin and the U.S. stock linkage, 2023 U.S. stocks may need to fall at least 20%-30%, and bitcoin although bottomed out, but follow the U.S. stock trend, is also expected to further fall so much, this view is seriously ignore the impact of bitcoin's own economic cycle, more one-sided.

Outlook: Bitcoin Trends Analysis for 2023

From a short-term perspective, the crypto market does have a lot of institutional entry this round, and the process of institutional deleveraging may be relatively long. While the short-term chain data does show a bottoming signal, further downward testing cannot be ruled out. Bitcoin is very strongly supported near $16,000 below, where most mainstream miners have machine prices, which means that even if there is a very black swan event, Bitcoin will recover in a relatively short period of time, with more powerful support on the lower side in the $10,000-$13,000 range.

A macroeconomic bear market could push bitcoin to $10,000 and ethereum to $1,000 support, but a recovery rally is inevitable for both cryptocurrencies as the Federal Reserve shifts to easing. in 2023, bitcoin has key support at $10, 000 and resistance at $40, 000.