Smart Money Tracker: What are crypto VCs investing in?

Smart Money Tracker: What are crypto VCs investing in?

Despite the market sentiment, cryptocurrency venture capital firms continue to expand aggressively in different areas and show no signs of stopping.

As the market changes, the focus of crypto VCs is also changing.Understanding their investment trends means understanding the needs of the industry.This article digs into some of the top VCs' investment information from the first quarter of this year to give you some reference and also to see what the future narrative of the industry might be.

First, a summary of crypto venture capital investment profiles for Q1 2022.

Total investment: $14.1 billion

Number of investment projects: 681

2021 profile as a comparison.

Total investment: $30.4 billion

Number of investment projects: 1349 projects

1 quarter of 2022 alone.Crypto VCs have already invested half as much as they did in all of last year.

01

What are exchange-based VCs investing in?

We start by dividing the encrypted VCs into two categories.

First category.Exchange VC, representatives: Coinbase Ventures, Alameda+ FTX, Binance Labs.

The second category.Top Crypto VCRepresentatives: a16z, Paradigm, Sequoia, Multicoincap, Polychain, 3AC, DCG, etc.

Statistically, the first category of crypto VCs' investment results in the first quarter of this year were: Coinbase Ventures ($1.4 billion), Binance Labs ($280 million), and Alameda ($1.3 billion). Investment breakdown.

DeFi: 31 (27%)

CeFi: 13 (11%)

NFT: 16 (14%)

DAO: 10 (9%)

Games: 20 (16%)

Others (wallet, Web3 infrastructure, L1, etc.): 24 (20%)

Pulling back the threads, I observed two of the more concentrated investment themes.

There are 5 cross-chain projects out of 31 DeFi projects. (16%)

Six of the 16 NFT projects are NFT financialization projects. (38%)

1. DeFiCross-chain of the board

The 5 bridge projects are: LayerZero (STG), Multichain (MULTI), Swim Protocol (SWIM), Router Protocol (ROUTE), Symbiosis (SIS)

In addition to SIS, several other bridges have raised funds from several well-known VCs, especiallySTGThe dazzling array of supporters of

Crypto VCs are not only smart money, they are also narrative creators.Between 2021-2022, FTX, 3AC, Hashed, and DCG chose SOL, AMAX, LUNA, and NEAR, respectively, and then fought the Layer1 battle.

In 2022, despite the Wormhole hack, cross-chaining is still the hottest topic for VCs.

2. NFTPrice discovery for NFT of the board

This should be extended to the broader topic of NFT financialization. When we only trade NFT itself, real-time price discovery is not important. But when NFT is combined with defi, things become different.

Imagine a lending scenario on BAYC. Suppose the fixed price of BAYC is 100 ETH and BAYC is traded once an hour. If BAYC is sold by a malicious attacker for 1 ETH, then many investors who borrow against their BAYC could face a significant liquidation of their funds, which is why price discovery is important.

02

What are the top crypto VCs investing in?

The top VCs' investments this quarter broke down as follows

DeFi: 34 (28%)

CeFi: 9 (7%)

NFT: 15 (12%)

DAO: 6 (5%)

Games: 18 (15%)

Others (wallet, web3 infrastructure, L1, etc.): 40 (33%)

Some of the more prominent investment themes were also identified from this.

Of the 34 DeFi projects, there are 4 option projects (12%).

Of the 40 infrastructure projects, there are 8 privacy+ expansion projects (20%).

1. DeFiOptions of the Board

The four option programs are Ribbon (RBN), Thetanuts (no coins issued), Exotic (no coins issued), and Friktion (no coins issued).

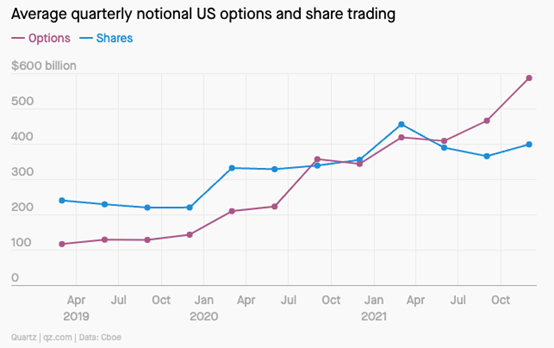

Why are options important? Because it is the most fundamental part of DeFi and because the derivatives market is large compared to the spot market.

Ordinary DeFi protocols provide returns with their own governance token, which is minted by the protocol. Unlike options, which provide returns generated by market mechanisms thatSo it's much more sustainable.

In the equity market, dated rights volume in 2021 ($450 million) exceeds daily spot volume ($405 million). In cryptocurrencies, Binance's daily derivatives volume ($56 billion) exceeds daily spot volume ($18 billion).

The on-chain options market is one of the most underserved markets in cryptocurrencies.

2. Rollup of infrastructure

Top venture capital firms are investing in privacy and scalability layers. Almost all infrastructure projects, including EspressoSys and Humanode, are trying to make the blockchain more private and scalable.

With the introduction of the zkEVM solution, ZK Rollup has become increasingly important. (Note: zkEVM is a virtual machine that executes smart contracts in a way that is compatible with zero-knowledge proof computing)

which is backed by a16z, Binance, Coinbase, DragonflyzkSyncThe main network is already online, and many projects are built on zkSync, such as DEX ZigZag, such as Syncswap, which has launched a test network, and VovoFinance and Connext, which announced support for the zkSync network.

Invested by Paradigm and Sequoia and favored by V-GodStarkWareStarkNet Alpha version 0.8.0 has also been released. The bridge to StarkNet, StarkGate, has been released as a beta network, and StarkNet native dapps such as JediSwap, yagi, and mySwap are waiting to go live.

In addition, both exchange VCs and top crypto VCs are keen to invest inDAO governance tools and games.

For DAO governance tools, we need a true Web3 native social platform, for example, there are already projects working on a Discord with Metamask login; for games, this has been a favorite section for VCs, for example, the recent MaviaGame, which raised both from Alameda, Binance and Mechanism which raised $8 million from both Alameda, Binance and Mechanism.

We conclude with a review of crypto VC action in the first quarter of the year.

1. In 1Q22, crypto VCs invested $14 billion, equivalent to the total 202150%.

2. Exchange-based VCs invest more"Bridge"."NFT Fi

3. Top venture capital firms invest more"Options"and"ZK"

4. Exchange VCs and top-tier venture capital firms are interested inDAO and GamesShowing an increasing interest.

Recommended Articles

Contract Check

Black technology tools